This blog post is a follow-up of a previous article tracing the history of China’s air transport industry (A Portrait of the Chinese Airlines Industry in 2019 (Part I): a Historical Perspective). Part II aims at mapping the airline ecosystem and showing how the so-called “Big Four” (Air China, China Eastern, China Southern, HNA Group) are dominant in the current landscape.

A Few Words on Methodology

This entire article is based on the Planespotters database [1]. Planespotters is a highly comprehensive crowd-sourced database of all aircraft currently in service. Their data on Chinese aircraft was gathered in January 2019, and used to make the graphs below. Credit regarding the raw data is given to Planespotters, which has made this article possible.

The Domination of the “Big Four”

China’s airline industry of 3500+ aircraft in 2019 (excluding cargo, business jets) is heavily dominated by 4 airline groups, commonly referred to as the “Big Four”: Air China, China Southern, China Eastern, and HNA Group. The first three stem from the split-up of the former state-owned CAAC Airlines, and are also known as the “Big Three”. They are still predominantly state-owned, which is a significant difference with the fourth player, HNA Group, a private company. Despite all Chinese airlines benefitting from significant government support and subsidies, the “Big Three”, as the state-owned flagship carriers of China, receive particular attention from authorities (see Part I: a Historical Perspective).

Put together, the “Big Four” represent 84% of the entire Chinese aircraft fleet, while the fifth airline, Sichuan Airlines Group, represents a mere 5.5%, which is three to four times less on average than any of the “Big Four”. The domination would most likely be even more striking if number of passengers transported were taken into account, since “independent” airlines (those which don’t belong to the “Big Four”) tend to operate more regional routes with smaller aircraft.

Fig. 1 – Block Chart of Chinese airlines’ fleet size (full size image here)

Fig. 1 – Block Chart of Chinese airlines’ fleet size (full size image here)

Fig. 2 – Group Fleet Size (including cargo, excluding business jets)

Fig. 2 – Group Fleet Size (including cargo, excluding business jets)

Airline Group Mapping and Strategy

Each airline group is composed of a core airline (Hainan Airlines for HNA Group, etc.) and a major historical airport base (Haikou for HNA Group, Beijing for Air China, Shanghai for China Eastern, Guangzhou for China Southern). Each of these groups also have a strong presence outside their historical base, for multiple reasons:

- The genealogy of the “Big Three” Airlines: when CAAC Airlines was split up in the 1980s and later consolidated in 2002, Air China was formed of the former Air China based in Beijing, and China Southwest based in Chengdu. The same is true for China Southern (which absorbed China Northern based in Shenyang) and China Eastern (which absorbed China Northwest, based in Xi’an)

- The acquisition of competitors: in order to increase geographic coverage or relieve competition in saturated airports: Air China took a stake in Shenzhen Airlines, Hainan Airlines in Tianjin Airlines, China Eastern acquired Shanghai Airlines…

- The CAAC’s relax of the entrance and exit of an air route, enabling airlines to enter new routes not directly connected to their home bases. China Southern and Xiamen Airlines daily flights between Shenzhen and Beijing, home bases of airlines from the Air China Group. It is not uncommon today to have 5 or more airlines competing on busy air routes on the Eastern coast.

Fig. 3 – Mapping of the “Big Four” airlines (full size image here)

Fig. 3 – Mapping of the “Big Four” airlines (full size image here)

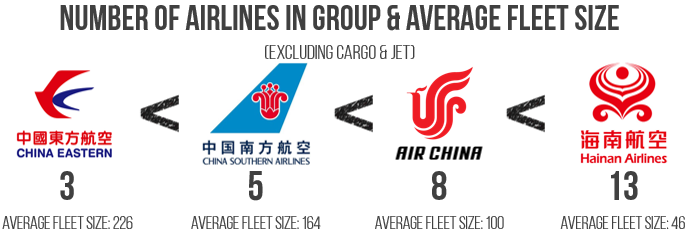

In terms of number of airlines, HNA Group seems to have significantly more than its other three major competitors: 13, rather than 3, 5 or 8 (if we exclude cargo and business jets). This is due to some small legacy companies which were purchased in the 2000s and still flying under their former flag (Shan Xi Airlines, Grand China Air, Xinhua Airlines…). The future aircraft of these three companies will most likely be reunified under the Grand China Air banner in the future.

The other reason is HNA Group’s heavy investment in new regional and low-cost carriers in the last 10 years. CAPA for example reported that among the 19 airlines in the launch phase at the end of 2014, a good 7 was pushed and invested by HNA Group and its subsidiaries [2].

Fig. 4 – Number of Airlines in each Group & Average Fleet Size

References

[1] Planespotters.net web page

[2] China’s 19 new passenger airlines will be mostly full service and along the east coast, CAPA, November 2014