Introduction

You may have heard of Beidou, the Chinese satnav constellation and rival of the American GPS, Russian Glonass, and European Galileo. 2020 marked a major milestone for Beidou, with the completion of the constellation deployment on June 23 2020, on board a Long March 3B rocket. This deep dive article discusses the development of Beidou over the past 20 years and its strategic importance for China.

Historical perspective

The idea of having an independent GNSS constellation isn’t specific to China and has occured to many other industrialized countries. The main reasons for this is the increasingly strategic role that GPS, the first such satnav constellation, has played since its debute in the 1990s. GNSS services have highlighly useful military applications ranging from the guiding of missiles to the navigation for military aircraft, ships and vehicles. In the case of China, according to Chinese media narratives, there were several “wake-up calls” in 1990s:

- The Yinhe Incident in 1993: in which the US suspected a Chinese cargo ship (“Yinhe Hao”) of carrying chemical weapons for Iran, and used several means to strand the Chinese ship in international waters, including disrupting GPS signals. [1]

- The Third Taiwan Strait Crisis in 1996: in the run-up to the presidential election in Taiwan in 1996, then president-candidate Lee Teng-hui was seen as having independance leaning policies by Beijing, who responded by launching a number of missiles close to northern Taiwanese waters as a sign of discontent. Various accounts of this event reveal that these missiles failed to reach target due to the US disrupting GPS signals. The US had increased military presence as a response to growing military activity in the Strait. [2]

Furthermore, growing confrontation between the US and China as well as the South China Sea territorial claims made the launch of an indigenous GNSS constellation all the more relevant for China.

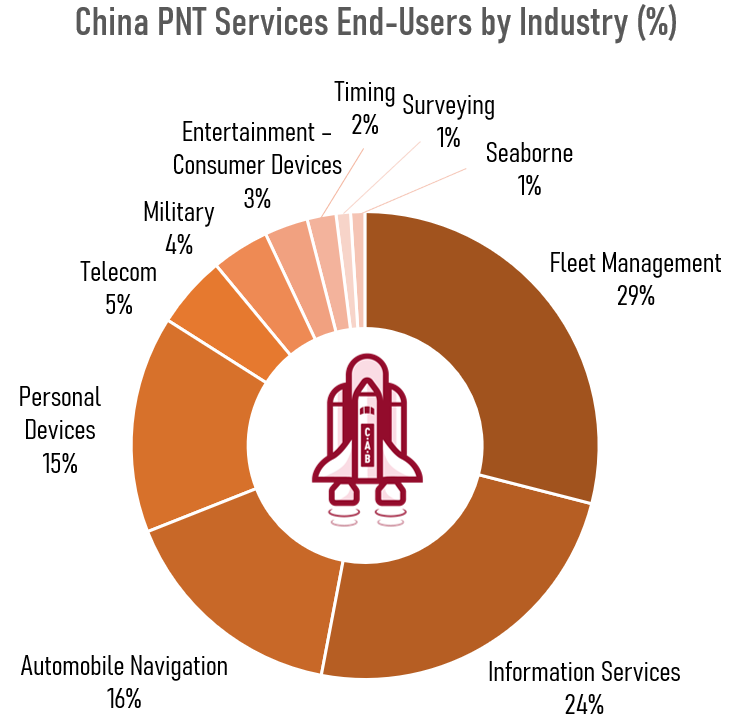

Civil applications have also boomed since the 2000s: navigation in personal cars, positioning services in smartphones, professional applications within industries such as fishing, disaster relief, mining, rail, banking, etc. With the dawn of the age of AI, new applications will make precise PNT (Positioning, Navigation and Timing) even more critical: autonomous driving, urban air mobility, precision agriculture, smart city, etc. Critical infrastructure such as 4G/5G networks also rely on PNT. All these reasons have made having an independent GNSS constellation very appealing to China.

“Beidou” is actually the Chinese name for the Big Dipper constellation, which was historically an important reference point for navigation in China. The Beidou project encompasses a 3-step development plan which would see 3 generations of satnav systems be set up: Beidou-1, Beidou-2, and Beidou-3.

- Beidou-1 (2000-2012): the initial Beidou constellation consisted of a triplet of geostationnary satellites, aimed at providing active PNT services and covering exclusively the territory of China. It was deployed between 2000 and 2003, and was decomissioned in 2012.

- Beidou-2 (2004- ): Developed between 2004 and 2012, the following Beidou constellation was a more advanced satnav constellation aimed at serving the Asian-Pacific region. Interestingly, it differs from other GNSS constellations by combining MEO satellites with GEO and IGSO satellites (respectively 4, 5, and 5 satellites). GPS, GLONASS and Galileo on the other hand are purely MEO constellations. PNT services starting from Beidou-2 were mainly passive.

- Beidou-3 (2013- ): the latest and most advanced iteration began its development in 2013, and keeps a similar hybrid constellation architecture, with 24 MEO satellites, 3 GEO satellites, and 3 IGSO satellites. While the MEO satellites provide the worldwide coverage, the GEO and IGSO satellites aim at enhancing performance and services for China and Asia Pacific countries, and are placed strategically above this region (see Fig. 3). The constellation was completed on June 23rd 2020 with the launch of the ultimate GEO satellite. The 3 GEO satellites are positioned at 80E, 110.5E and 140E respectively, while the IGSO satellites are in an inclined orbital plane of 55 degrees. The 24 MEO satellites are evenly distributed in 3 orbital planes.

Beidou-3 also comprises a ground segment, composed of a number of ground stations, as well as inter-satellite links, which enable satellite telemetry and control without having a global network of ground stations.

While already experimenting with its first (modest) Beidou-1 GNSS system in the early 2000s, China had also initially considered collaborating with the European Union for a global coverage constellation: Galileo. As early as in 2003, China commited a 200 million EUR participation into the EU-led GNSS constellation, becoming the largest non-European partner of the project. But wariness from some EU members due to the military applications of GNSS, frustration from China for being treated as a “secondary” partner, and the fallout of the initial Galileo public-private financial plan in 2006 definitely marginalized China, which decided to go its own way with Beidou-2 and ultimately the Beidou-3 constellation [4][5][6]. In hindsight, this may have been for the best as both powers have grown increasingly concerned about keeping an upper hand on critical infrastructure, of which GNSS satellite constellations are undoubtedly a part of.

Features and Services of Beidou 3

As can be expected of a GNSS constellation, Beidou-3 provides global Position, Navigation and Timing services (PNT), with an accuracy comparable to GPS and Galileo. It also provides SAR services, enabled by 6 MEO satellites and following international SAR standards. Interestingly, Beidou also provides a messaging function, limited to 40 Chinese characters beyond the China/Asia-Pacific region.

Within China and Asia-Pacific, Beidou-3 functionalities are strongly enhanced, underlining the additional regional function of Beidou. Messaging character limits are increased to 1000 Chinese characters, thanks to the coverage of the 3 GEO satellites in the region. These GEO satellites also provide SBAS* services, called BDSBAS, which is a satellite-based GNSS augmentation technology which enhances signal integrity and accuracy. SBAS services are notably useful for civil aviation, which require more precise PNT information. SBAS is only available in China and surrounding areas. China is also developing GBAS** services, called BDGBAS, which similarly provide GNSS augmentation based on a network of local ground stations computing and broadcasting correction signals. While the space segment of the Beidou-3 constellation (ie. the satellites) were completed in June 2020, these more sophisticated GNSS augmentation services are still in the deployment phase and should be completed by 2025 based on various reports by China’s Satellite Navigation Office (CSNO) [7][8].

*SBAS: Satellite-based Augmentation System

**GBAS: Ground-based Augmentation System

Beidou-3 satnav services can also be used with a number of other enhanced precision technologies such as RTK (Real Time Kinematics) and PPP (Precise Point Positioning), which find uses in applications such as surveying, construction, UAV navigation, or mining. An overview of these technologies are available in [9].

Why is Beidou important for China?

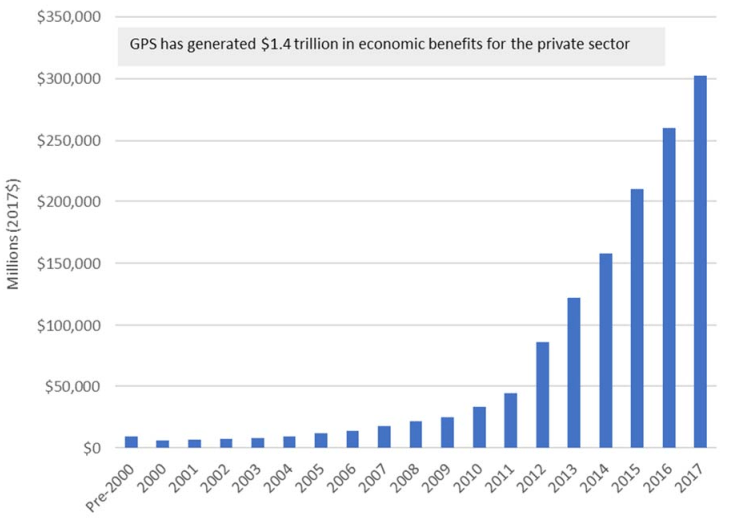

As discussed earlier, Beidou is strategic for the Chinese military, and was the primary motivation for setting up a separate satnav constellation. Beyond military considerations, there is also the dependence of modern critical infrastructure on satnav (banking, telecoms, …), and the economic benefits of building up a home-grown GNSS industry. According to RTI’s 2019 GNSS Report [9], civil GPS applications, products and services have generated combined economic benefits of 1.4 trillion USD between the 1980s and 2017. Furthermore, about 90% of these economic benefits were generated over the past 10 years alone, highlighting the exponential potential of GNSS applications when combined with new technologies.

It is commonly agreed today that the use of GPS still dominates over the use of GLONASS, Galileo and Beidou. The US is also the leading country in terms of GNSS industry revenue generation, accounting for 28% of the global revenue in 2019 (followed by Europe at 27%, Japan at 20%, and China at 10%) [10]. This is likely due to the presence of key US companies in upstream and downstream industries (components, antennas, chips, integrators, internet companies, …).

Worth noting for Beidou, the Asia-Pacific region (including the Indian subcontinent) represents 53.2% of the global GNSS installed base, and approximately 1/3 in revenue, in 2019. And perhaps most interestingly, the GNSS device per capita is at 0.8 in the region (versus 1.4 and 2.0 in Europe and the US respectively), highlighting the growth potential for the GNSS industry in this region [10].

What market share can Beidou hope to capture in the future?

The Beidou value chain, just like GPS, can be divided into the 3 segments: the space segment, the ground segment, and the user segment. All three segments are made possible by an impressive number of specialized companies (Fig. 6). While the space and ground segments consist essentially of state-owned conglomerates (notably academies and institutes of CASC and CETC), the user segment represents a mix of both state-owned and commercial companies. This is a classic in the space industry in China where infrastructure considered to be critical is closed to commercial companies while the downstream value chain is much less regulated.

(sources: Beidou 2020 White Paper, Tianfeng Securities Report, 前瞻经济学人)

According to the China’s Satellite Navigation and Location Services Industry 2020 White Paper, “the total output value of China’s GNSS and Location-based services” in 2019 was of 345 billion CNY (approximately 49 billion USD), a 14,4% increase compared to 2018 [11]. According to the same report, the representativeness of the Beidou constellation in the total output value was of approximately 80% in 2019. This figure is impressive, especially for a constellation that has been operational locally only for a decade or so. These figures are probably boosted by the fact that Beidou space and ground segments are taken into account (this wouldn’t be the case for GPS for example).

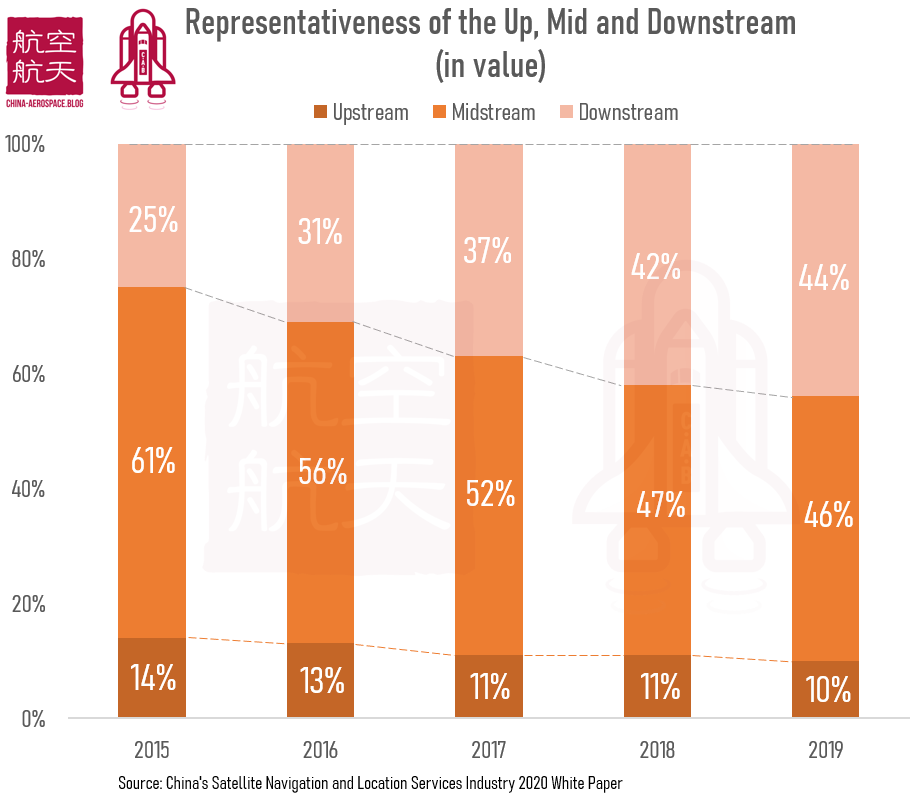

The user segment is probably the most interesting to unpack, and is by far the fastest growing segment with the greatest diversity of companies, including both state-owned and privately-held firms. The user segment can be further subdivided into the upstream, middle and downstream blocks:

- Upstream: companies making notably chips, antennas, electronic boards, and other hardware or software modules.

- Midstream: integrators and terminal manufacturers.

- Downstream: companies operating and providing GNSS-based services to the end-user.

The 2020 White Paper also gives interesting insights regarding the importance of each vertical. While upstream and midstream companies represented 75% of the user segment in value in 2015, this has shrunk to 56% in 2019, with downstream companies experiencing rapid growth and reaching 44% (see Fig. 7).

One of China’s key advantages for the adoption of Beidou in the future will be the strong position many Chinese companies are taking in emerging satnav-dependant applications such as autonomous driving (Baidu Apollo, Pony.ai, Xpeng), urban air mobility (Ehang), 5G (Huawei, ZTE), smart cities (Alibaba), industrial UAVs (DJI), maritime (COSCO, CIMC), the list goes on. This represents a significant vector of promotion of Beidou-based solutions abroad.

In the upstream parts of satnav, China also has an interesting number of startups. Companies like Weilai Daohang and Geespace are building GNSS enhancing satellite constellations, with the high accuracy needs of autonomous driving in mind. The case a Geespace is especially interesting, the parent company being Geely, one of China’s largest domestic automobile companies.

The Chinese government has also had a central role in supporting the development of the domestic satnav industry chain. This is especially true for the upstream segment, where Chinese officials have made clear that they want to encourage the use of home-grown chips [12], and want the satnav core infrastructure to avoid any reliance on foreign suppliers. This has been emphasized on a regular basis, one such example being the 2021 New Year Gala where Beidou-3 Chief Designer Xie Jun announced to the public that Beidou had achieved the feat of being 100% Made in China (百分之百国产化). Chinese authorities have also regularly drafted White Papers and Reports, documenting closely the development of China’s satnav industry, identifying strengths and weaknesses, laying out solutions and areas of untapped growth. Beidou satnav standards (北斗卫星导航标准体系) have also been published since 2015 in a push for a widespread adoption abroad [13][14].

Local governments have also been supportive through the creation of Beidou-centered industrial parks, providing facilities and investment to domestic startups. One such initiave is the Beidou Innovation Base in Beijing, launched in 2020 and aiming at fostering “product development, industry incubation, international cooperation, industry exchange, and application experience” [15][16]. Outbound political strategies such as BRI (Belt and Road Initiative) are also likely to promote Chinese-designed and manufactured satnav solutions.

Ultimately, China has one final asset. As the global electronics manufacturing powerhouse, it is able to bring prices down due to the sheer volumes of production and a strong knowledge in manufacturing cost control. That being said, the ability of Chinese companies to win away substantial market shares from current well-established international competitors in foreign markets remains to be seen.

References

[1] No Chemical Arms Aboard China Ship, The New York Times, September 6 1993

[2] Unforgettable humiliation’ led to development of GPS equivalent, South China Morning Post, November 13 2009

[3] 一文带你了解中国北斗卫星导航系统产业市场发展现状分析 产业链下游增长迅速,前瞻经济学人,June 2020

[4] 中欧伽利略计划已有11个项目签署合同并开始实施, gov.cn, April 13 2006

[5] Chinese Square Off With Europe in Space, The New-York Times, March 23 2009

[6] 中国不满成伽利略计划配角 靠北斗二代证明实力, 南华早报, January 3 2008

[7] Update on Beidou Navigation Satellite System, Dr. Jun Shen, September 2016

[8] Update on Beidou Navigation Satellite System, Peng Jia, December 2019

[9] GNSS Augmentation, ESA Navipedia

[9] Economic Benefits of the Global Positioning System (GPS), RTI International, June 2019

[10] GSA GNSS Market Report, Issue 6, European Global Navigation Satellite Systems Agency, 2019

[11] China’s Satellite Navigation and Location Services Industry 2020 White Paper, 2020, China GNSS and LBS Association

[12] China to deliver latest BeiDou positioning chip at the end of 2020, CGTN, September 2020

[13] Beijing launches innovation base for Beidou industry, Xinhua News, August 2020

[14] Beijing releases 3-year plan to support industries related to BeiDou GPS satellite, China.org.cn, March 2020

[15] Des utilisations commerciales de la constellation Beidou (1/2), East Is Red, August 9 2020

[16] 北斗卫星导航标准体系 (1.0版), 全国北斗卫星导航标准化技术委员会, January 2015

[17] 置完成10亿元A轮融资 公司估值超130亿元, 腾讯科技, October 19 2019